If you think all published chart are too technical do let me know, i will make it easy to read.

September 30, 2009

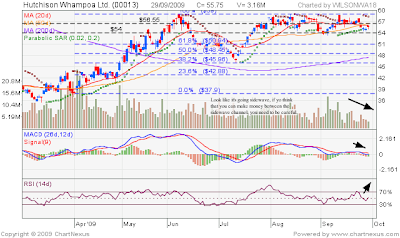

HKSE : Equity that i monitor

I had made the commnet inside the chart...so enjoy and have fun.

Any question, pls do send me and email or make comment at this blog. thx

Any question, pls do send me and email or make comment at this blog. thx

SGX : Property stocks

Hi all,

I think you all may would like to knowhow does property stock look like after announcement Government.

Coincidently all show a begining of down trend parabolic.Perhaps we should have a target price and time the timing to go in.

Allgreen.(Land bank in Singapore)

I think you all may would like to knowhow does property stock look like after announcement Government.

Coincidently all show a begining of down trend parabolic.Perhaps we should have a target price and time the timing to go in.

Allgreen.(Land bank in Singapore)

September 28, 2009

NYSE:Citigroup

Hi all,

Let's see what will happen tonight in USA.

Citigroup can hold their ground or not....

My target is below 4USD

Let's see what will happen tonight in USA.

Citigroup can hold their ground or not....

My target is below 4USD

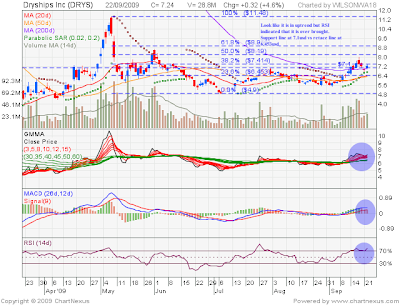

Nasdaq: Dryship

DRYS touched 6.37 USD last friday and i ssume it will go down further since the whole Asia stock ex. goes down.

Last Friday closed:6.36USD

Resistance:6.4USD

Support:6.01USD

My Target:5.82USD

Last Friday closed:6.36USD

Resistance:6.4USD

Support:6.01USD

My Target:5.82USD

SGX: Raffles Edu

Raffles is at the edge of 200 MA......getting risky. If it break 200 MA I will cut lost.

Today closed:0.515Sgd

Resistance:0.53Sgd

Support:0.51Sgd

My target:0.48Sgd

What say u??

Today closed:0.515Sgd

Resistance:0.53Sgd

Support:0.51Sgd

My target:0.48Sgd

What say u??

SGX: China Hongx

Hi guys,

Seem like all share goes down today (Good opportunity?) This counter break the support line at the end of today.

Today closing:0.215Sgd

Resistance:0.22Sgd

Support:0.205Sgd

My Target :0.19Sgd

There are many more counters going down today....Will be ineteresting to know what will happen in USA tonight.

If you have any comment pls do so.....

Seem like all share goes down today (Good opportunity?) This counter break the support line at the end of today.

Today closing:0.215Sgd

Resistance:0.22Sgd

Support:0.205Sgd

My Target :0.19Sgd

There are many more counters going down today....Will be ineteresting to know what will happen in USA tonight.

If you have any comment pls do so.....

SGX : Allgreen

Hello all,

Watch out....Allgreen break the 1.13Sgd support line. It closed at 1.12sgd today.

I expect tomorrow it will test the support line again if it failed then it will go down to to next support line at 1.06sgd.

Resistance line : 1.2Sgd

Support line: 1.13Sgd

Today closed : 1.12Sgd

My Target :1.06Sgd

Good luck

Watch out....Allgreen break the 1.13Sgd support line. It closed at 1.12sgd today.

I expect tomorrow it will test the support line again if it failed then it will go down to to next support line at 1.06sgd.

Resistance line : 1.2Sgd

Support line: 1.13Sgd

Today closed : 1.12Sgd

My Target :1.06Sgd

Good luck

September 24, 2009

Market update: SGX China Hongx / Nasdaq:Dryship

Another big day in HKSE market...it drop >500 points today so watch out...

An update on above stock...

An update on above stock...

September 23, 2009

Interesting finding : DJ / HKSE /SGX

Hello all,

Look at the chart it look so similar and both are now over sold.....RSI indication shoot up sky high

Below is DJ vs HKSE....unfortunately i cannot get to see the vol of HKSE.

HKSE

SGX : Is similar as well except the MACD is divergence.

Look at the chart it look so similar and both are now over sold.....RSI indication shoot up sky high

Below is DJ vs HKSE....unfortunately i cannot get to see the vol of HKSE.

HKSE

SGX : Is similar as well except the MACD is divergence.

Nasdaq : Dryship

Hi, It retrace after it touched 8usd on 17Sept09......now it is 7.xxx...I will wait and see if the support line at 7.10 is strong enough, RSI indicated it is overbrought.

As long as it goes below 7.0usd you may need to watch out....

Enjoy

As long as it goes below 7.0usd you may need to watch out....

Enjoy

September 22, 2009

3 Counters for today 22Sept2009

SGX: China Hongx

I will wait for the best timing but not now...what will you do ??

SGX: China Zaino

What i see is the uptrend is facing huge resistance and may retarce very soon base on previous chart shown

NYSE: Citigroup

Down trend.....very nice....sorry that i have no Citigroup share at this moment

I will wait for the best timing but not now...what will you do ??

SGX: China Zaino

What i see is the uptrend is facing huge resistance and may retarce very soon base on previous chart shown

NYSE: Citigroup

Down trend.....very nice....sorry that i have no Citigroup share at this moment

Back from Holiday

Hello Guys,

Back from a long weekend, for those who live in Asia will know there was a Malay new year on Sunday so we have a day off yesterday. I do not celebrate Malay New Year but do enjoy the day off.

I open my computer yesterday a chk out the market in other region, HKSE dropped yesterday but today recovered(22Sept09), Nikkei dropped this morning may due to profit taking? or new government?

China market continue to drop for countinuously 2 days total arround 50 points, does it due to the trade barrier between USA? However, The Bank in China is getting higher risk due to the mortgage expanded too fast.......

Will try to analyse below counter in coming day

China Hongx

China Zaino

Citigroup

Back from a long weekend, for those who live in Asia will know there was a Malay new year on Sunday so we have a day off yesterday. I do not celebrate Malay New Year but do enjoy the day off.

I open my computer yesterday a chk out the market in other region, HKSE dropped yesterday but today recovered(22Sept09), Nikkei dropped this morning may due to profit taking? or new government?

China market continue to drop for countinuously 2 days total arround 50 points, does it due to the trade barrier between USA? However, The Bank in China is getting higher risk due to the mortgage expanded too fast.......

Will try to analyse below counter in coming day

China Hongx

China Zaino

Citigroup

September 17, 2009

NASDAQ : Dryship

Alamak, Dryship still continue the momentum to clear their way to above 7.0usd....7usd was the resistance line.

I would like to share with you some of their Key ratio.

DRYS DryShips Inc.

Price :7.48 +0.47

EPS:-20.96

Mkt Cap: 1.90B

Lt debt to Assest :15.10

Lt deby to equity : 36.38

Total debt to equity : 119.47

ROA:4.56

ROE:10.74

ROI: 8.05

Net Profit Margin: 27.97

Operating Margin:16.59

Revenue: 210.48

Net income:58.87

EBITA: 83.65

I would like to share with you some of their Key ratio.

DRYS DryShips Inc.

Price :7.48 +0.47

EPS:-20.96

Mkt Cap: 1.90B

Lt debt to Assest :15.10

Lt deby to equity : 36.38

Total debt to equity : 119.47

ROA:4.56

ROE:10.74

ROI: 8.05

Net Profit Margin: 27.97

Operating Margin:16.59

Revenue: 210.48

Net income:58.87

EBITA: 83.65

September 16, 2009

SGX property counters- after announcement of Government

Well, most retrace immediate on the day itself after announcement publish by Sgp Gov. I think everyone will ask what will happen next on all this counters? Many developer said it will not have big impact to them and perhaps it is refer to short term since they managed to get rid of inventory in last couples of month but how about long term..... In my personal believe is investor will slow down and see whether gov will take further action toward current property market.

Of course houses or condo will still sell simply because there are still people get marry, intend to upgrade their living place and etc.....

How about the company that listed in SGX, interesting to see what are they going to publish in next quarter.

I put "Allgreen" and "Capitaland" chart here, have a look and comment.

Capitaland

It is at the edge of the support line of MA30 and 60 days

Refer to MACD and GAMMA both seem like going to turn to down trend....

I will getting more intereting if it retrace to 3.46SGD but now the support line is at 3.7SGD.

My target to revisit this counter is when it touch 1.09SGD...... heeeehe...

Allgreen

What will allgreen react to the same announcement? Well goes down....

It closed at 1.14Sgd yesterday but today rebounce a bit to 1.16sgd so what does the chart say to me is NOT to go in, wait and see....

Of course houses or condo will still sell simply because there are still people get marry, intend to upgrade their living place and etc.....

How about the company that listed in SGX, interesting to see what are they going to publish in next quarter.

I put "Allgreen" and "Capitaland" chart here, have a look and comment.

Capitaland

It is at the edge of the support line of MA30 and 60 days

Refer to MACD and GAMMA both seem like going to turn to down trend....

I will getting more intereting if it retrace to 3.46SGD but now the support line is at 3.7SGD.

My target to revisit this counter is when it touch 1.09SGD...... heeeehe...

Allgreen

What will allgreen react to the same announcement? Well goes down....

It closed at 1.14Sgd yesterday but today rebounce a bit to 1.16sgd so what does the chart say to me is NOT to go in, wait and see....

September 14, 2009

SGX-Allgreen

The up trend is getting shorthen, possible to retrace?? Support level is now at 1.15SGD but if it is so then the trend tell it break the 30/200 days Moving average....problem it drop but opportunity is appearing infron of us.

Becareful guys....

Becareful guys....

Market view - 14 Sept 09

Hi...

Would like to share what i see and hear yesterday,

People a speculating the next Global buble is forming up due to many indication such as,

1.China Bubble

2.Green bubble ( Green tecnology such as solar power and etc...)

3.Gold price >1000 dollar ounce

4.First protest in USA against Obama medical stimulus plan

5.Inflation will come? due to depreciation of USD

6. Any others.....

I will withdraw my money from stock to see what will happen...

Rmember " MONEY is KING"

Would like to share what i see and hear yesterday,

People a speculating the next Global buble is forming up due to many indication such as,

1.China Bubble

2.Green bubble ( Green tecnology such as solar power and etc...)

3.Gold price >1000 dollar ounce

4.First protest in USA against Obama medical stimulus plan

5.Inflation will come? due to depreciation of USD

6. Any others.....

I will withdraw my money from stock to see what will happen...

Rmember " MONEY is KING"

NYSE-Citigroup

Hi,

Some one asked me what is my view on Citigroup, i did a chart analysis.

Finding

1.Retracing

2.Volume slow down

3.Macd : divergence

4.RSI : going down

5.MA30 : going to test MA30, will see this support line is good enough.

My suggestion

:Wait for the best time to buy , now be patient and aim....

Some one asked me what is my view on Citigroup, i did a chart analysis.

Finding

1.Retracing

2.Volume slow down

3.Macd : divergence

4.RSI : going down

5.MA30 : going to test MA30, will see this support line is good enough.

My suggestion

:Wait for the best time to buy , now be patient and aim....

September 11, 2009

SGX - Jaya Holding 11Sept09

Hi,

Jaya cannot hold the ground so it retrace back. Volume slow down and same indication shown in RSI.

Eventhough MACd is still convergence but it does not fulfill all my criteria so i will consider to take profit and stay away from the market for a while.

What say you??

Jaya cannot hold the ground so it retrace back. Volume slow down and same indication shown in RSI.

Eventhough MACd is still convergence but it does not fulfill all my criteria so i will consider to take profit and stay away from the market for a while.

What say you??

HKSE- China Cosco 11Sept2009

Hi all,

I sold my China cosco yesterday after i saw the momentum is weakening and it hit it resistance for last 2 days and today but cannot break through.

To reduce my risk and keep my profit, i decided to walk away with the profit and keep monitor of it.

Other reason is becuase the oil price goes up.....may affect their revenue performance

Sorry to say am a kia su guy...

I sold my China cosco yesterday after i saw the momentum is weakening and it hit it resistance for last 2 days and today but cannot break through.

To reduce my risk and keep my profit, i decided to walk away with the profit and keep monitor of it.

Other reason is becuase the oil price goes up.....may affect their revenue performance

Sorry to say am a kia su guy...

Market- 11Sept2009

Hi,

The market does not seem so right, USA market is losing momentum (slow and quiet) may going into side wave, It may reach the top and start to reverse?? no body know, do you? The rally in USA begin from Tuesday day after that it slow down. There are no news that support the rally except news that saying "Better then expected" which indicate the market still in trouble.

Yesterday, Prime minister of China(Mr.Wan) indicated that China will continue to have stimulus package to boost China domestic market to sustain the economy growth, This also tell the china market need more money and does song it is recover, otherwise why the government pour in more money.

Again, Gold price is going up same as Oil prices. When oil price reached 100usd perhaps the inflation will come a 2nd recession appear??

I decided to reduce what i have in the stock market and keep the cash with me for a while, As you may still remember, during the recession Cash is KING.

good luck and start to be more careful when you buy and sell in the market.

The market does not seem so right, USA market is losing momentum (slow and quiet) may going into side wave, It may reach the top and start to reverse?? no body know, do you? The rally in USA begin from Tuesday day after that it slow down. There are no news that support the rally except news that saying "Better then expected" which indicate the market still in trouble.

Yesterday, Prime minister of China(Mr.Wan) indicated that China will continue to have stimulus package to boost China domestic market to sustain the economy growth, This also tell the china market need more money and does song it is recover, otherwise why the government pour in more money.

Again, Gold price is going up same as Oil prices. When oil price reached 100usd perhaps the inflation will come a 2nd recession appear??

I decided to reduce what i have in the stock market and keep the cash with me for a while, As you may still remember, during the recession Cash is KING.

good luck and start to be more careful when you buy and sell in the market.

September 10, 2009

Market

Wow, is so volatile....after yesterday a big drop (all asia market are red) in Asia today the market rebounce, By the way RED in china have a difference meaning ok?

Just intend to continue with "Jaya Holding" story, It is building a strong support at 0.49SGD level ...hoepfully it can goes up furter to hit my target the i will cao.

Others stock that am in monitoring are

SGX

-Synear

-Hongguo

-Kepple land

-Keppel corp

-Raffles Edu

HKSE

-HSBC

-Hutchinson

-China Cosco

-Sinopec

USA

-City group

-Freddie and Fannie Mac

-Dryship

-GE

see u

Just intend to continue with "Jaya Holding" story, It is building a strong support at 0.49SGD level ...hoepfully it can goes up furter to hit my target the i will cao.

Others stock that am in monitoring are

SGX

-Synear

-Hongguo

-Kepple land

-Keppel corp

-Raffles Edu

HKSE

-HSBC

-Hutchinson

-China Cosco

-Sinopec

USA

-City group

-Freddie and Fannie Mac

-Dryship

-GE

see u

September 09, 2009

SGX : Jaya Holding 09Sept09

Hi there,

After 2 days rally Jaya take a break in today morning, it retrace back to 0.495sgd and is the 3rd candle. A quick overview attached, MACD is in convergence, RSI is indicating a over brought, volume start to slow down. However, the trend shown it is still in uptrend channel and may retrace to test the support line at 0.47sgd./ 2nd support line is at 0.43sgd.

My suggestion is "Hold" or "Sell" if you intend to reduce risk.

Since i'm not having a huge amount of this share so i will hold to see whether after the retracement "Jaya" can rally to hit 0.55sgd or not and if it is not then i will take my money backloh.

Like what i expected yesterday night, HKSE market retrace by -199point in the morning.

Marco view

-Gold price hit over 1001USD again...smell like what happened in 2007

-Oil prices goes up to 71.32usd due to depreciation of USD

-Unemployment in USA is better then expected but still sky high

If oil price hit 100usd again then inflation happen and a double dip in economy will happen?? What say you??

Stay tune

After 2 days rally Jaya take a break in today morning, it retrace back to 0.495sgd and is the 3rd candle. A quick overview attached, MACD is in convergence, RSI is indicating a over brought, volume start to slow down. However, the trend shown it is still in uptrend channel and may retrace to test the support line at 0.47sgd./ 2nd support line is at 0.43sgd.

My suggestion is "Hold" or "Sell" if you intend to reduce risk.

Since i'm not having a huge amount of this share so i will hold to see whether after the retracement "Jaya" can rally to hit 0.55sgd or not and if it is not then i will take my money backloh.

Like what i expected yesterday night, HKSE market retrace by -199point in the morning.

Marco view

-Gold price hit over 1001USD again...smell like what happened in 2007

-Oil prices goes up to 71.32usd due to depreciation of USD

-Unemployment in USA is better then expected but still sky high

If oil price hit 100usd again then inflation happen and a double dip in economy will happen?? What say you??

Stay tune

NYSE : Freddie Mac

Hi guys,

another late night. Tempting to see what will happen in US market after today rally in Asia and especially HKSE (440 points..wow) will tomorrow retrace, most likely since it had been rally in last week and extended to this week. Anyway let's focus in US market. Since one of my friend is holding Freddie Mac so i did a quick check of this counter. it retrace once last week and seem like it will do it again (see attached picture) base on the today performance which it going down of it trend, volume and MACD is divergence.

Volume it lower show it momentum is getting weakening so if i brought it below 1usd last time, i will take some profit and buy back later.

**************

Target buy : 1.752usd base on fibonacci retracement untill it confirm this support line is strong

Target Sell : 2.0usd

**************

My target margin is low because i'm not a long term invertor for this account and close to 10% margin will be good for me. I trade Freddie for only short term, as you know this counter have no fundamental at all now this equal to high risk to me.

\

I have an issue to make the picture or photo bigger so you can see the details, any advice??

Hoep you make some banus this week and enjoy

another late night. Tempting to see what will happen in US market after today rally in Asia and especially HKSE (440 points..wow) will tomorrow retrace, most likely since it had been rally in last week and extended to this week. Anyway let's focus in US market. Since one of my friend is holding Freddie Mac so i did a quick check of this counter. it retrace once last week and seem like it will do it again (see attached picture) base on the today performance which it going down of it trend, volume and MACD is divergence.

Volume it lower show it momentum is getting weakening so if i brought it below 1usd last time, i will take some profit and buy back later.

**************

Target buy : 1.752usd base on fibonacci retracement untill it confirm this support line is strong

Target Sell : 2.0usd

**************

My target margin is low because i'm not a long term invertor for this account and close to 10% margin will be good for me. I trade Freddie for only short term, as you know this counter have no fundamental at all now this equal to high risk to me.

\

I have an issue to make the picture or photo bigger so you can see the details, any advice??

Hoep you make some banus this week and enjoy

September 08, 2009

SGX-Hongguo

Hongguo perform slidely better uptill yesterday, However, I have not get the confirmation that this counter will rally in this week so far because of the volume and RSI are acting differently compare to the stock moving direction. I will suggest to monitor further whether or not to buy this share. However, I would say this is a counter can go for long term investment. see my previous comment.

Enjoy.

Enjoy.

SGX-Jaya Holding 08Sept2009

seem like Jaya had successfully breakthrough the triangle and closed at SGD$0.505 yesterday,

It still chung again today...I predict it will have a first resistanse at SGD$0.535 and next resistanse will be SGD$0.56.

If look at the other indication like volume and RSI are going up and up. MACD just turned into convergence.

It still chung again today...I predict it will have a first resistanse at SGD$0.535 and next resistanse will be SGD$0.56.

If look at the other indication like volume and RSI are going up and up. MACD just turned into convergence.

September 07, 2009

SGX-Hongguo

Hi all,

Hongguo, This is a dragon share listed in SGX. Their major activities is design,manufacture and distribute fashion shoes for Female and Male both in Asia and USA. some data to share.

The over all performance look good and the stock is under value, so what say you??

I did another check on this stock with Fibonacci Fan, it shown it is still within the the uptrend. If you purchase this stock to keep as long term it shouldn't be an issue but short term will need to be close monitor. Actuall for all short term trader need to be monitor closely for all their stock.

some other indication such as MACD/RSI and MA all shown positive and again what say you, you decide your fortune...:)

Size: Pricing: (Mil SGD)

Market Capitalization :(SGD) 125.015

Previous Closing Price :(0.315)

Revenues :(SGD) 186.424

Pricing Date :(2009-09-04)

EBITDA :(SGD) 30.525

Net Income :(SGD) 22.444

52 Week High 0.350/Low 0.110

3 years historical high is SGD$ :1.45

Profitability Ratios

Gross Profit Margin (%) 39.394

Operating Profit Margin (%) 15.041

Net Profit Margin (%) 12.039

Pretax Margin (%) 11.011

Management Effectiveness

ROA (%) 14.604

ROE (%) 19.919

ROI (%) 19.888

Hongguo, This is a dragon share listed in SGX. Their major activities is design,manufacture and distribute fashion shoes for Female and Male both in Asia and USA. some data to share.

The over all performance look good and the stock is under value, so what say you??

I did another check on this stock with Fibonacci Fan, it shown it is still within the the uptrend. If you purchase this stock to keep as long term it shouldn't be an issue but short term will need to be close monitor. Actuall for all short term trader need to be monitor closely for all their stock.

some other indication such as MACD/RSI and MA all shown positive and again what say you, you decide your fortune...:)

Size: Pricing: (Mil SGD)

Market Capitalization :(SGD) 125.015

Previous Closing Price :(0.315)

Revenues :(SGD) 186.424

Pricing Date :(2009-09-04)

EBITDA :(SGD) 30.525

Net Income :(SGD) 22.444

52 Week High 0.350/Low 0.110

3 years historical high is SGD$ :1.45

Profitability Ratios

Gross Profit Margin (%) 39.394

Operating Profit Margin (%) 15.041

Net Profit Margin (%) 12.039

Pretax Margin (%) 11.011

Management Effectiveness

ROA (%) 14.604

ROE (%) 19.919

ROI (%) 19.888

China Cosco is one of the largest dryship company in China and it also listed in SGX as "Cosco Corp" since it is from from China i will be more interesting to investigate and study their share listed in HKSE. Why not buy direct from Shanghai or Shenzen stock exchange? Well it will cost more commision and a lot of barriers to sell the stock that you purchase. "Play safe"

Let's us first look into China cosco then , Cosco Corp in SGX.

It retarce when it touch HKD$12.73 in early August09 and till now it taken 3weeks only for it to retace back to HKD$9xx, when an announcement made last week about their earning are not good(>600 Mil Lost). But since last week the market feel that this price is under estimeted this counter and started to rose(Also new in China of keeping the same R&R for the Bank).

Today half day price is (07Sept09/HKD$10.34) so did you manage to buy any? The target price should be HKG$12.7 but to be save you can set you target to sell at HKD$11.5. A possibility to make 10% margin...emm not bad

Summary

Today :HKD$10.34

Last wk:HKD$9.58

Target buy: now

1st Target sell:HKD$11.5 (11.2% margin)

2nd Target sell:HKD$12.50 (20.88% margin)

so you decide.....

Let's us first look into China cosco then , Cosco Corp in SGX.

It retarce when it touch HKD$12.73 in early August09 and till now it taken 3weeks only for it to retace back to HKD$9xx, when an announcement made last week about their earning are not good(>600 Mil Lost). But since last week the market feel that this price is under estimeted this counter and started to rose(Also new in China of keeping the same R&R for the Bank).

Today half day price is (07Sept09/HKD$10.34) so did you manage to buy any? The target price should be HKG$12.7 but to be save you can set you target to sell at HKD$11.5. A possibility to make 10% margin...emm not bad

Summary

Today :HKD$10.34

Last wk:HKD$9.58

Target buy: now

1st Target sell:HKD$11.5 (11.2% margin)

2nd Target sell:HKD$12.50 (20.88% margin)

so you decide.....

Hi guy,

I just posted a counter "Jaya holding"/SGX, Seem like this counter will be come to an end of the down trend or consolidation and reverse since a Doji appear, As you know when a doji appear the trend may reverse after it consolidate for last whole week. If it can break through S$0.46 and go up then next target to sell will be S$0.695.

Enjoy and comment

I just posted a counter "Jaya holding"/SGX, Seem like this counter will be come to an end of the down trend or consolidation and reverse since a Doji appear, As you know when a doji appear the trend may reverse after it consolidate for last whole week. If it can break through S$0.46 and go up then next target to sell will be S$0.695.

Enjoy and comment

Subscribe to:

Posts (Atom)

-640x488.png)

-640x416.png)

-640x416.png)

-640x379.png)